Global and European Mining Lubricant Market Outlook 2025 to 2035

The mining lubricant market is projected to grow from USD 2.5 billion in 2025 to USD 4.2 billion by 2035, at a CAGR of 5.4%.

NEWARK, DE, UNITED STATES, November 19, 2025 /EINPresswire.com/ -- The global Mining Lubricant market, valued at USD 2.5 billion in 2025, is projected to reach USD 4.2 billion by 2035, expanding at a CAGR of 5.4%, according to the latest market outlook. Growing mechanization, predictive maintenance adoption, a shift toward synthetic formulations, and expanding mining activities across major regions are setting the stage for a decade of sustained growth.

Mining hubs across APAC, Europe, the USA, and Saudi Arabia are collectively driving demand as operators push to reduce equipment downtime while improving efficiency in increasingly harsh environments.

Oils Remain the Dominant Product Type with 93.0% Share in 2025

The oils segment will retain its leadership with a 93% revenue share in 2025, driven by its versatility, heat resistance, and high load-bearing capabilities. Oils continue to support the performance of draglines, loaders, excavators, crushers, and haul trucks used extensively in coal, metal, and mineral extraction.

This dominance is reinforced by investments in preventive maintenance programs and adherence to stricter global safety and environmental standards.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-6505

Synthetic Lubricants Capture a 90% Market Share

Synthetic lubricants are expected to represent 90% of total mining lubricant revenues in 2025, supported by their superior thermal stability, oxidation resistance, and ability to perform under extreme pressure and temperature.

As modern mining equipment becomes more sophisticated and automated, the industry shift toward high-performance synthetic lubricants is accelerating—especially in regions with extreme climate conditions such as Saudi Arabia and North America.

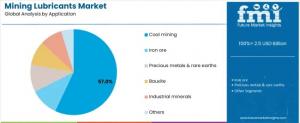

Coal Mining Leads Applications with a 57% Market Share

The coal mining segment will account for 57% of market share in 2025, driven by heavy machinery usage, abrasive operating environments, and the rising demand for coal in developing nations.

China and India, which rely on coal for 58% and 64% of power generation respectively, are major contributors to this segment’s dominance.

Regional Outlook: APAC, Europe, USA & Saudi Arabia Take Center Stage

APAC: Fastest-Growing Regional Hub

APAC continues to be the largest growth engine for mining lubricants.

- India is projected to grow at a CAGR of 7.6%, reaching USD 346 million by 2035, backed by major policy overhauls, infrastructure projects, and foreign investment inflows.

- China remains the world’s mining powerhouse, expected to reach USD 1,053.5 million by 2035 with a 6.5% CAGR, supported by vast coal and metal mining operations and local lubricant manufacturing capabilities.

- South Korea and Japan will maintain steady growth, driven by specialty mining applications and high-tech machinery.

Europe: Strong Momentum Driven by Technology & Sustainability

Europe, led by Germany, the UK, and Nordic countries, is increasingly adopting eco-friendly and high-temperature lubricants to support underground and remote mining operations. The region’s strict emission and equipment standards support the shift to synthetic and bio-based solutions.

USA: Accelerating Adoption of Eco-friendly, High-Performance Lubricants

The United States is set to grow at a 4.2% CAGR, reaching USD 368.24 million by 2035. Rising copper, coal, and gold extraction, combined with a surge in autonomous and remotely operated mining systems, is raising demand for advanced lubricant formulations. Stringent environmental regulations continue to push the adoption of low-toxicity and biodegradable lubricants.

Saudi Arabia: Mining Diversification Fuels Lubricant Demand

In alignment with Saudi Vision 2030, the Kingdom’s mining sector is expanding rapidly as it aims to become a global mineral hub. Investments in precious metals, rare earth minerals, and industrial minerals will boost lubricant consumption, particularly high-temperature and extreme-pressure lubricants essential for desert mining conditions.

Gain complete access to the report for extensive coverage of market forecasts, competitive benchmarking, and evolving industry trends! https://www.futuremarketinsights.com/checkout/6505

Industry Trends Shaping Market Growth

1. Predictive Maintenance Driven by AI & IoT

Mining firms globally are integrating AI and IoT sensors into critical machinery to monitor lubricant levels, viscosity, and contamination in real time. Predictive analytics help avoid breakdowns and reduce maintenance costs, accelerating demand for “smart-compatible” lubricant formulations.

2. Surging Demand for High-Temperature & Extreme-Pressure Lubricants

Deep-sea and underground mining operations are driving demand for advanced lubricants capable of functioning efficiently in extreme heat and high-pressure environments.

3. Rising Coal & Base Metal Demand

The increasing global demand for iron ore, bauxite, copper, and precious metals—driven by infrastructure development and electrification—is fueling lubricant consumption across both emerging and advanced markets.

4. Cost Barriers for Small-Scale Miners

While high-end synthetic lubricants offer long-term benefits, many smaller mining companies remain price-constrained and rely on cheaper alternatives, preventing full market penetration of premium solutions.

Competitive Landscape

The market remains moderately consolidated with leading Tier 1 companies—Shell, ExxonMobil, BP (Castrol), TotalEnergies, Chevron, PETRONAS, LUKOIL, FUCHS, and Petro-Canada Lubricants—controlling 31% to 36% of global share.

Tier 2 players operate regionally with specialized product portfolios, while Tier 3 companies continue to serve niche local markets.

Recent Industry Developments

- April 2025: Shell launched new Shell Helix Ultra motor oils with up to 4% improved fuel efficiency.

- April 2025: Shell and Ducati extended their global partnership to co-develop high-performance engine oils.

- March 2025: Shell Indonesia announced its first grease manufacturing plant in Jakarta to expand regional output.

Exploring Insights Across Emerging Global Markets:

Wind Turbine Blade Repair Material Market: https://www.futuremarketinsights.com/reports/wind-turbine-blade-repair-material-market

Phthalate and Non-Phthalate Plasticizers Market: https://www.futuremarketinsights.com/reports/phthalate-and-non-phthalate-plasticizers-market

Malonic Acid Market: https://www.futuremarketinsights.com/reports/malonic-acid-market

Hindered Amine Light Stabilizers (HALS) Market: https://www.futuremarketinsights.com/reports/hindered-amine-light-stabilizers-market

Styrene-butadiene-styrene (SBS) Block Copolymer Market: https://www.futuremarketinsights.com/reports/styrene-butadiene-styrene-block-copolymer-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.